3. Challenging Keynesian Economics: from scandals to solutions

The road to economic stability in uncertain times

In essence, Keynesian economics is a macroeconomic theory developed by British economist John Maynard Keynes (“Keynes”) in the 1930s in response to the Great Depression. The central tenet of this school of thought is that government intervention can stabilise the economy.

Keynes believed that free markets have no self-balancing mechanisms, and thus, government intervention through public policies to achieve price stability and full employment. These beliefs have led to our current central bank debt-based economy.

According to the International Monetary Fund (“IMF”), 3 core tenets underlying Keynesian economics include:

Aggregate demand is influenced by many economic decisions… public and private

Prices, especially wages, respond slowly to changes in supply and demand

Changes in aggregate demand, whether anticipated or unanticipated, have the greatest short-run effect on real output and employment, not on prices.

Everyone who has studied economics at school is familiar with Keynesian economics, however, recent developments have raised certain questions regarding its sustainability in the long-term.

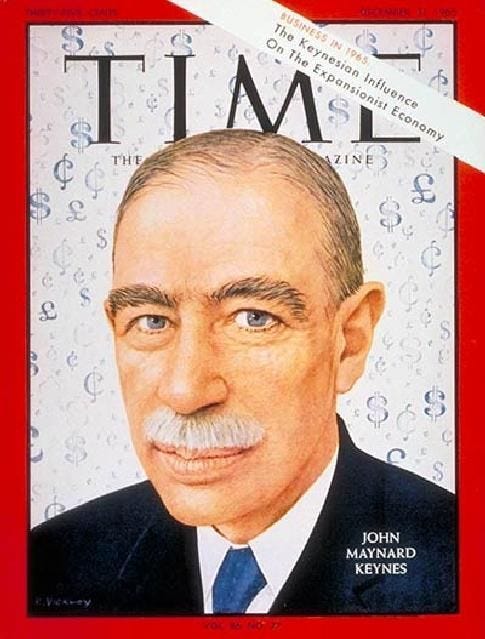

Who is John Maynard Keynes?

Keynes (1883 - 1946) studied at King’s College at Cambridge University, earning an undergraduate degree in mathematics but received no known formal training in economics. His most famous work is his book titled “The General Theory of Employment, Interest, and Money” published in 1936. He also is described by many as the intellectual founding father of the IMF and the World Bank.

However, few people are aware of Keynes's darker side. According to Forbes, Keynes kept an extensive sexual diary referencing “his liaisons with boys well into his adult years and in at least one case the age is specified at 16”. Consider he was about 28 years old at this time. We also find correspondence with his lover Lytton Strachey to tour Tunis where “bed and boy are also not expensive”.

In fact, he kept detailed records of such encounters, with names or initials of partners allocated by year. In a piece by the Atlantic, they even made reference to coded terms used by Keynes including “16-year old under Etna”, “Lift boy of Vauxhall” in 1911, and “Jew boy” in 1912. He also had a second more detailed diary, however, is written in code that has not been deciphered yet.

The relationship between Keynesian Economics and War

Wars tend to be very expensive. Historically if you wanted to fund a war within a democracy, you would need to go to the people and convince them to contribute a portion of their wealth to the cause. This could be achieved through increases in taxation or the issuance of war bonds.

This process acted as a deterrent for any power-hungry individuals wishing to start a war, making them think twice about such a decision. I hope we all can agree that this ‘friction’ is a good thing. This is because for a war to be carried out, at a minimum the general public must be convinced of its reasonableness, given that they will directly be paying for it.

However, this deterrent was removed the second we empowered central banks to be able to print paper money and moved off the gold standard. In fact, when moving off the gold standard US President Nixon stated that “I am now Keynesian in economics”. In turn, countries were now able to fund wars without direct authorisation from the public, with the people taxed indirectly instead through inflation.

"Many tyrants such as Hitler, Stalim, Mussolini, Mao… all ruled in periods of unsound government-issued money which they could print at their will to finance their totalitarian megolomania. Once sound money was destroyed, it became very easy for these criminals to take over power and command of all their society’s resources by increasing the supply of unsound money” - Saifedean Ammous in The Bitcoin Standard

For example, prior to WW1, the UK needed to finance the war effort and their attempt to raise capital from the bond market was a massive failure, generating less than 1/3 of its initial target. This shortfall was secretly covered by the Bank of England, with Keynes in a memo sent to the Treasury Sectory in 1915 describing it as a ‘masterly manipulation’.

At the same time, many news reporters, such as The Financial Times reported that “the war loan was over-subscribed by £250 million, with applications still pouring in”. This created a false sense of belief that the general public supported the war effort. This sort of propaganda has always been around and is more prevalent today than ever.

Disclosure of the failed fundraising, as was the case, would have been disastrous. This was why the Bank of England stepped in and ‘cooked the books’. Consider that The Financial Times issued a correction… but it was 103 years too late. Take this moment to reflect on potential coverups being carried out today that you are told to ignore, only for your children to get to know 100 years later…

The impact of the $ as the World’s reserve currency

As explained by Ray Diallo, the $ is currently the reserve currency of the world. This means that every time the US government prints money to promote economic growth, it increases the supply of $. Given that most central banks hold $ to trade with, they will end up having their $ devalued i.e. fall in purchasing power.

Due to the US’s excessive printing, this has forced other countries to find a solution. This resulted in the formation of BRICS. This comprises Brazil, Russia, India, China, South Africa, Saudi Arabia, UAE, Iran, etc… which now have a combined GDP that surpasses the G7.

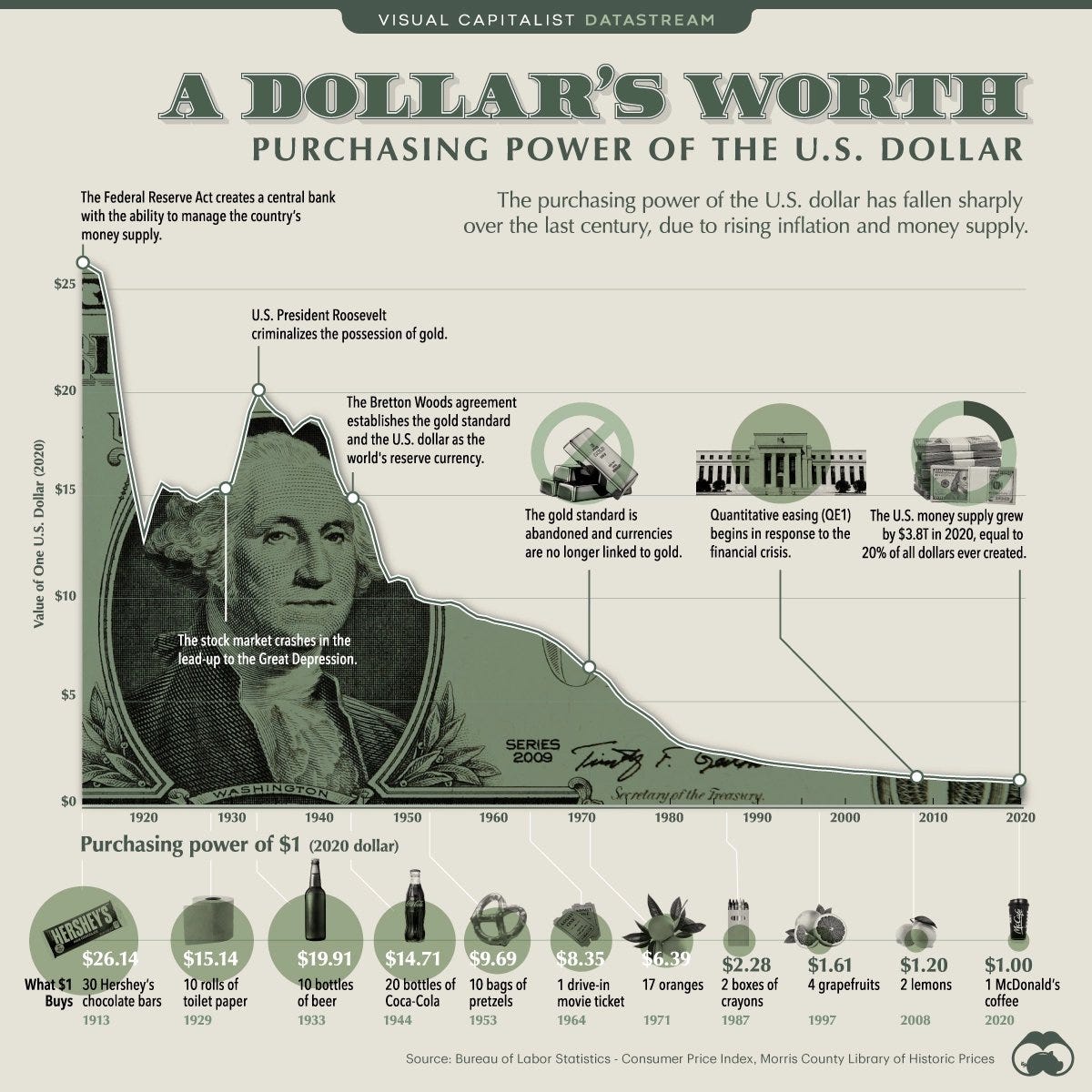

Inflation

Does it ever feel like your wage keeps increasing but the amount of things you can buy, such as at the supermarket keeps decreasing? That is inflation which is causing your purchasing power to fall, meaning you are worse off today than you were a few years ago, even if the numbers in your bank account are a little higher!

Inflation can be defined as a “tax on the poor”, unfairly discriminating against the poorer members of society who do not hold real assets, instead having most of their net worth in cash. Keynesian economics by design is anti-saving, and a consequence of this is the ever-increasing inflation rates we are experiencing.

To understand the devasting impact of inflation simply look at Venezuela, Lebanon, Argentina, and Turkey. Let’s not even go into how countries like the US artificially manipulate the measurement of the inflation rate to be lower than it actually is. That is a story for another time.

Within Keynesian economics, you empower the central bank to ‘steer the ship’. Most people seem fine with this. I do not, preferring a laissez-faire approach where the market will self-regulate itself following the natural order, akin to laws of thermodynamics. In essence, you cannot create something from nothing, as the printing of money tries to achieve. A self-correction is inevitable, as the pendulum swings both ways. Another way of looking at it is that for every reaction, there must be an equal and opposite reaction.

You must also make 2 big assumptions. That the people making the decisions i) will act in your best interest and ii) know what they are doing i.e. competence. For example, the banks followed these 2 assumptions. Let’s see how this played out for them.

As explained by Balaji, the Fed publishes forecasts on what rate they intend to set every quarter. For example, in December 2020, the forecast rates for 2023 were 0.1%, while in reality, they were 4.75% which is around 47x off.

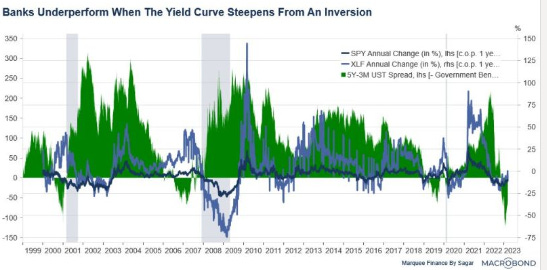

In Dec-21 the FED stated that inflation was transitory, resulting in banks buying bonds with customer deposits. They then proceeded to suddenly hike rates making the bank’s bonds considerably less valuable overnight. This was one of the determinants of the chaos witnessed by Silicon Valley Bank (“SVB”) a short while back, forcing the government to step in. Nonetheless, this acts more as a bandaid, meaning we are not in the clear yet.

National Debt

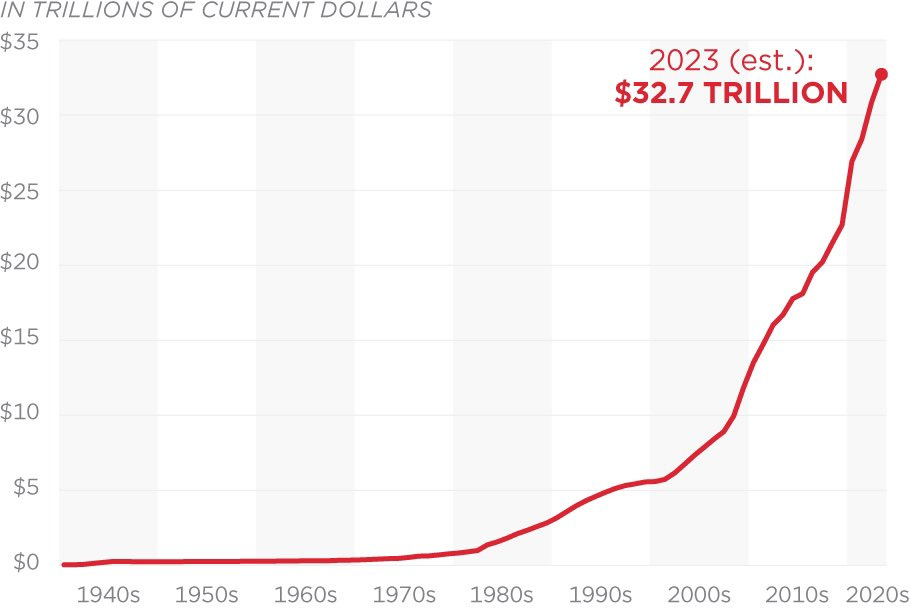

National debt keeps on increasing raising questions on if this is sustainable. For example, within the US, the national debt increased to $32 trillion in June 2023, which is about $95,000 per US person. For context, the US debt-to-GDP ratio increased from 31% in 1980 to 135% in mid-2020. Fitch Ratings downgraded the US Long-Term Foreign-Currency Issuer Default Rating from AAA to AA+ on 1 Aug 2023 citing “high and growing general govt debt burden”.

This is a worldwide problem, with Japan’s debt-to-GDP ratio rising to 217% as of 2021 and Croatia's 688%. To pay back old debt, governments simply create new debt, which is akin to playing a game of ‘hot potato’, especially given that interest must be paid on this debt. Should the bond market break down (which seems likely) this will raise the cost of financing to every country’s national debt, and also crush loan portfolios of virtually insolvent banks trying to hang on.

Given there is no limit to how high the debt ceiling can rise, there is no deterrent to lawmakers who continually make poor decisions focused on short-run wins, forgoing the long run and lining up their own pockets along the way. This is because any poor decision can easily be remedied by simply printing more money.

What can you do about this?

Well, one solution that completely changes the landscape is Bitcoin. In this case, we have an in-built finite supply of 21 million BTC. In the year 2140, no more Bitcoin will be produced, essentially becoming deflationary. For the time being though, a small amount of Bitcoin is still minted. This amount decreases by half every halving i.e. every 4 years. For context, around 90% of the total supply that Bitcoin will ever have has already been minted i.e. introduced into the money supply.

While Keynesian economics is more focused on the short-term and is dependent on government intervention, Bitcoin offers a transparent and decentralised alternative to FIAT money i.e. one that is borderless and has no central authority. This brings about both advantages and disadvantages that will be explored another time.

Nonetheless, in such a world, people will have full control over their wealth without having to rely on intermediaries. In an era of economic uncertainty and concerns about excessive money printing, Bitcoin may end up offering an alternative form of money.